Birkenstock: A business that fits Raamdeo's QGLP framework

QGLP: Quality, growth, longevity at reasonable price

In this blog, we would look at one of the affordable luxury brands which can compound earnings at 20% CAGR and is available at 26 PE.

About the Business

Birkenstock is widely perceived as a premium/affordable luxury comfort footwear brand with a unique blend of heritage, orthopaedic functionality, and fashion relevance. It operates a vertically integrated premium footwear business rooted in a 250-year heritage.

Let us look at products of the company and people’s perception of the brand to understand it more:

1. How People Perceive Birkenstock

Comfort-first with orthopaedic roots: Many consumers associate the brand with foot health, arch support, and long-lasting comfort due to its cork-latex footbed.

Heritage and authenticity: Established in 1774 in Germany, Birkenstock is seen as a heritage brand that stayed true to its values.

Fashionable and minimalist: In recent years, especially after collaborations with brands like Rick Owens, Dior, and Manolo Blahnik, it's become popular among fashion-conscious millennials and Gen Z.

Premium and aspirational: Post-IPO and with luxury backing (e.g., LVMH-linked private equity), the brand is increasingly seen as accessible luxury.

Sustainable and responsible: Known for using natural materials (e.g., cork, leather, jute), which resonates with eco-conscious consumers.

2. What Do People Buy at Birkenstock

People primarily buy:

Sandals (core product category)

Most iconic styles:

Arizona – two-strap sandal (unisex)

Boston – closed-toe clog

Gizeh – thong sandal

Madrid – single strap

Closed shoes (growing category)

Sneakers, boots, and clogs for colder seasons

Kids' sandals and shoes

Work-specific footwear (e.g., healthcare, hospitality)

Accessories: Socks, footbeds, belts, and skincare (via Birkenstock Natural Skin Care)

3. Where Are Birkenstocks Worn

Everyday casual settings: Ideal for walking, shopping, errands

At home: As indoor comfort footwear

On vacations: Especially in warmer climates, for city tours or beach towns

Urban and campus wear: Popular among students and urban dwellers in cities like Berlin, Amsterdam, New York, San Francisco, London

Work environments: Engineers, chefs, baristas, and retail staff wear Boston or Super-Birki clogs for all-day support. Steve Jobs used to wear Birkenstocks 😆

Fashion-forward contexts: Styled with socks, dresses, and tailoring – especially in Scandinavian, Japanese, and Korean streetwear

Business Model

Key elements of the business model:

Own Manufacturing & Supply Chain – 95% of production is in Germany, 100% in Europe, with 96% of raw materials sourced within Europe. This enables quality control, scarcity-driven distribution, and insulation from supply chain disruptions.

This is a bit special as unlike most brands which out-source manufacturing to low cost locations in Asia, Birkenstock has stayed course throughout its history to make in Germany and source from Europe. Vertical integration is their one of the main strengths.

Dual Channel Approach –

B2B (Wholesale): ~60% of revenue, sold through 12,000+ high-quality partner doors globally. Over 90% of growth comes from existing partners expanding shelf space and assortment.

DTC (Direct-to-Consumer): ~40% of revenue, this revenue stream is primarily e-commerce and they also have 90 owned stores (on track for 100 by FY25 year-end). Stores showcase full assortment, drive higher ASP, and often deliver payback within 12–18 months.

Category & Geography Expansion –

APAC Region: Fastest-growing geography (2x the growth rate in mature markets), with strong traction in China, Japan, and Australia. Americas & EU are its mature markets.

Premium Leather & Professional/Outdoor Segments: Expanding beyond sandals to higher-value, multi-season categories.

Not one product company:

Closed-Toe Shoes Growing at ~2x group average, are now ~1/3 of revenue.

Engineered Distribution & Scarcity Model –

Birkenstock controls allocation to preserve brand equity. This is the same principle each luxury brand follows. The scarcity principle, when applied to luxury goods, is a marketing strategy where limited availability increases desirability and perceived value. By creating a sense of exclusivity, luxury brands can drive up demand, even at high price points, because consumers associate rarity with prestige and quality.

This has led it to maintain >90% full-price realization and prevent channel oversupply.

Management

Birkenstock was a family owned business until early 2010s when a person named “Oliver Christian Joachim Reichert” came in as a consultant in 2009 to help calm family disputes. He had no background in footwear business but was appointed as CEO in 2013. Since then he is known for transforming the brand to next level. Revenue grew at 18% CAGR in last decade since he joined the business and he managed to drive high growth without sacrificing on profitability. He has made “the right choices over the last decade” maintaining a delicate balance between growing the company and staying true to its mission. In 2021 a private equity backed by LVMH took a majority stake in the business and eventually it led to an IPO in 2023 of this 250 year old brand.

Brand Power

If you remember Barbie movie from 2 years ago, Birkenstock is the brand which got lot of attention after that movie. Birkenstock didn’t have an official product collaboration with Barbie, rather, it got a big pop in visibility from a prominent cameo in the 2023 Barbie movie.

In the film, Margot Robbie (playing Barbie) wears a pink pair of Birkenstock Arizona sandals in a pivotal scene.

This moment, widely dubbed “the Birkenstock moment”, became a cultural talking point and drove a surge in searches, social media mentions, and sales for the brand.

The company and analysts noted it as a form of free celebrity/product placement that boosted awareness, especially among younger consumers, and contributed to higher near-term demand.

Oliver Reichert (CEO) factored this into IPO valuation assumptions as the “Barbie buzz”, with a one-year spike in growth but some enduring customer retention effects.

Birkenstock has had several celeb led unpaid promotional events and some prominent collabs with fashion houses like Dior.

1990s Kate Moss Vogue Cover – Boosted brand with the grunge/retro trend.

Steve Jobs – Wore Birkenstock Arizonas; his personal pair sold at auction for over $200,000.

Gwyneth Paltrow, Kendall Jenner, Heidi Klum, Frances McDormand – Regular wearers spotted in public.

Frances McDormand Oscars (2019) – Wore gold Birkenstocks with her gown.

Dior – Reworked the Arizona sandal with premium materials, embellishments, and Dior branding (sold for ~$1,500).

Manolo Blahnik – Jewel-encrusted Arizona and Boston models (2022).

Pricing power

On July 1, 2025, Birkenstock raised prices in the U.S. to partially offset the 15% baseline tariff on EU imports.

Impact: Six weeks after the increase, velocity and sell-through in the US were exceptional, even exceeding Q3 levels, with “no impact whatsoever” on demand

Financials

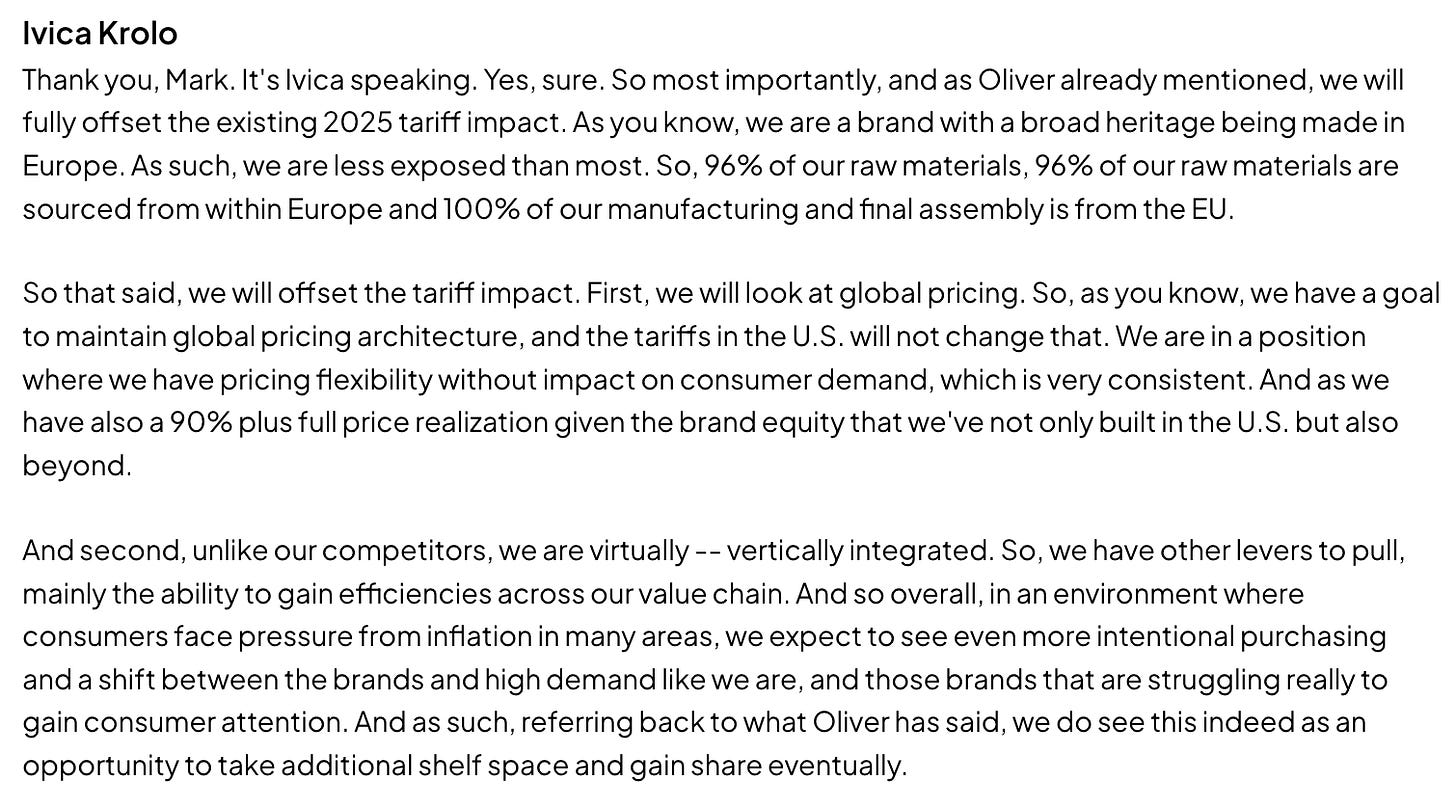

Now let us look at financials to understand more about the company.

Revenues have grown between 15-20% range barring latest quarter where FX headwinds due to USD depreciation agains EUR and shift in China growth to Q4 FY25 shows optically lower growth.

Revenues have grown with high single digit volume growth and mid single digit ASP growth

The company takes annual price increases and improves product mix to get ASP growth.

Gross margins have been healthy around ~60%.

There is clearly operating leverage visible in SG&A as these have not grown in line with revenues.

The company’s interest cost has reduced over last 2 years as it paid down debt from IPO proceeds

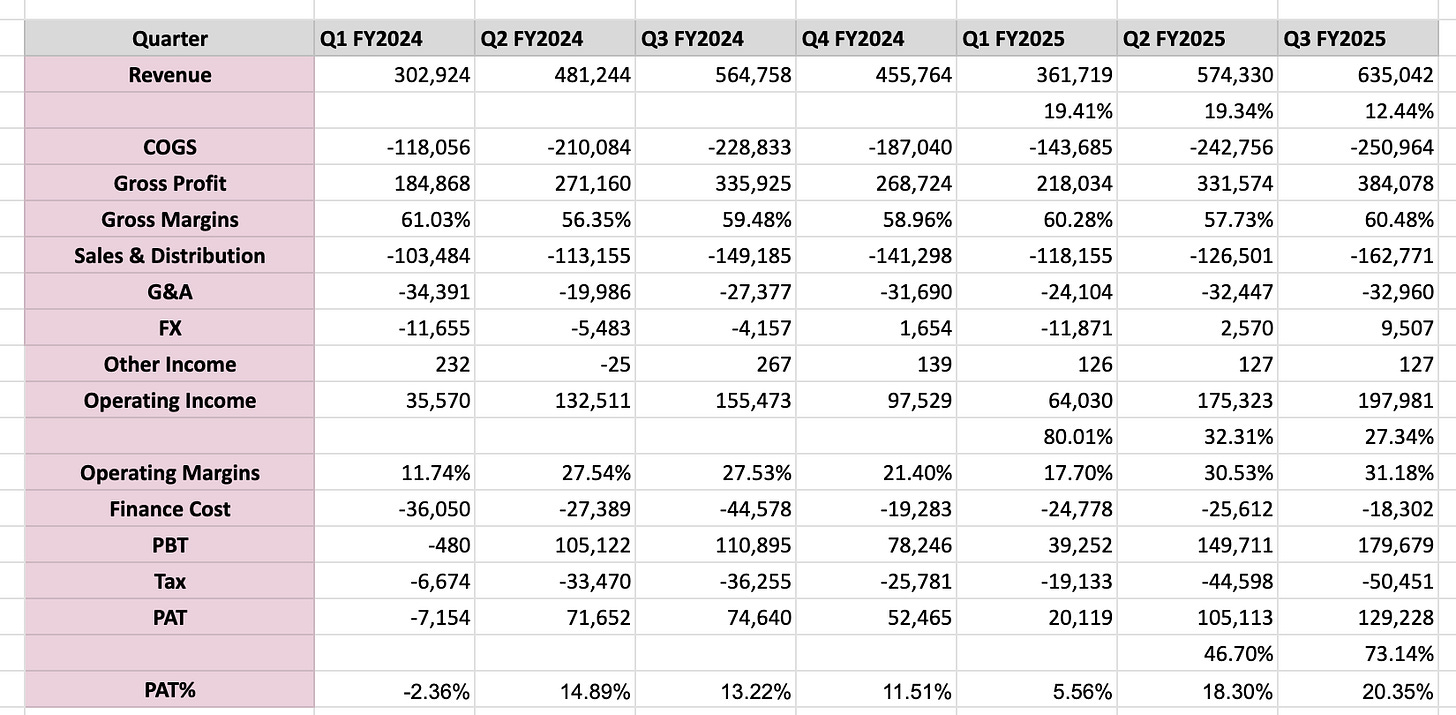

Let us look at channel mix and geography mix to understand some key points in the business:

Americas has been the primary market over the years for Birkenstock

APMA (Asia + Middle East) has been fastest growing market for the brand and especially China growth has been blockbuster for them which is bit opposite to other luxury players like LVMH etc.

The company focus is more on B2B as the management feels that since the products are more touch and feel based, this channel gives them good growth. However on DTC side, the focus is to open more own stores and grow that part of the business. The payback in its own stores has been 12-18 months. B2B is lower gross margin and higher EBITDA margins while for DTC it is reverse.

Valuations & Summary

Management is targeting mid to high-teens constant currency revenue growth, coupled with margin expansion. With this trajectory, EPS could compound at around 20% annually over the next 3–5 years, aided by share buybacks funded through the company’s robust free cash flow. At a current valuation of roughly 26x P/E, the multiple appears reasonable given the expected growth profile and the brand’s enduring strength. Given there is INR depreciation, this could offer 20%+ returns to Indian investors in INR terms.

The primary risk lies in fashion and trend cycles, there could come a time when consumer interest in Birkenstock wanes. The key will be how effectively the company innovates to keep the brand fresh and relevant. That said, with a 250-year heritage and deep-rooted brand loyalty, there’s a strong foundation for enduring appeal.

In essence, Birkenstock stands as a textbook example of Raamdeo Agrawal’s QGLP framework:

Quality, Growth, Longevity at a Reasonable Price.

Disclaimer: I am NOT a SEBI registered advisor or a financial adviser registered anywhere. Any information I share on my blog are provided for educational purposes only and do not constitute specific financial, trading or investment advice. I may or may not be invested at time of writing the blog or later on. The blog is intended to provide educational information only and does not attempt to give you advice that relates to your specific circumstances. You should discuss your specific requirements and situation with a qualified financial adviser.